Economy – Agriculture – CROP INSURANCE

CROP INSURANCE

Introduction:

- Crop or Agriculture Insurance covers risks of anticipated loss in yield of various crops.

Pradhan Mantri Fasal Bima Yojana

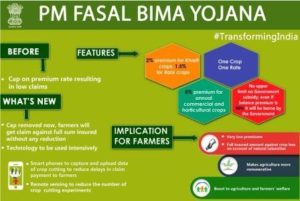

- The new Crop Insurance Scheme is in line with One Nation – One Scheme theme. It incorporates the best features of all previous schemes and at the same time, all previous shortcomings / weaknesses have been removed. The PMFBY will replace the existing two schemes National Agricultural Insurance Scheme as well as the Modified NAIS.

Objectives

- To provide insurance coverage and financial support to the farmers in the event of failure of any of the notified crop as a result of natural calamities, pests & diseases.

- To stabilise the income of farmers to ensure their continuance in farming.

- To encourage farmers to adopt innovative and modern agricultural practices.

- To ensure flow of credit to the agriculture sector.

Highlights of the scheme

- There will be a uniform premium of only 2% to be paid by farmers for all Kharif crops and 1.5% for all Rabi crops. In case of annual commercial and horticultural crops, the premium to be paid by farmers will be only 5%. The premium rates to be paid by farmers are very low and balance premium will be paid by the Government to provide full insured amount to the farmers against crop loss on account of natural calamities.

- There is no upper limit on Government subsidy. Even if balance premium is 90%, it will be borne by the Government.

- Earlier, there was a provision of capping the premium rate which resulted in low claims being paid to farmers. This capping was done to limit Government outgo on the premium subsidy. This capping has now been removed and farmers will get claim against full sum insured without any reduction.

- The use of technology will be encouraged to a great extent. Smart phones will be used to capture and upload data of crop cutting to reduce the delays in claim payment to farmers. Remote sensing will be used to reduce the number of crop cutting experiments.

- PMFBY is a replacement scheme of NAIS / MNAIS, there will be exemption from Service Tax liability of all the services involved in the implementation of the scheme. It is estimated that the new scheme will ensure about 75-80 per cent of subsidy for the farmers in insurance premium.

Farmers to be covered

- All farmers growing notified crops in a notified area during the season who have insurable interest in the crop are eligible.

- Compulsory coverage : The enrolment under the scheme, subject to possession of insurable interest on the cultivation of the notified crop in the notified area, shall be compulsory for following categories of farmers:

- Farmers in the notified area who possess a Crop Loan account/KCC account (called as Loanee Farmers) to whom credit limit is sanctioned/renewed for the notified crop during the crop season. and

- Such other farmers whom the Government may decide to include from time to time.

- Voluntary coverage : Voluntary coverage may be obtained by all farmers not covered above, including Crop KCC/Crop Loan Account holders whose credit limit is not renewed.

Risks covered under the scheme

- Yield Losses (standing crops, on notified area basis). Comprehensive risk insurance is provided to cover yield losses due to non-preventable risks, such as Natural Fire and Lightning, Storm, Hailstorm, Cyclone, Typhoon, Tempest, Hurricane, Tornado. Risks due to Flood, Inundation and Landslide, Drought, Dry spells, Pests/ Diseases also will be covered.

- In cases where majority of the insured farmers of a notified area, having intent to sow/plant and incurred expenditure for the purpose, are prevented from sowing/planting the insured crop due to adverse weather conditions, shall be eligible for indemnity claims upto a maximum of 25 per cent of the sum-insured.

- In post-harvest losses, coverage will be available up to a maximum period of 14 days from harvesting for those crops which are kept in “cut & spread” condition to dry in the field.

- For certain localized problems, Loss / damage resulting from occurrence of identified localized risks like hailstorm, landslide, and Inundation affecting isolated farms in the notified area would also be covered.

Unit of Insurance

- The Scheme shall be implemented on an ‘Area Approach basis’e., Defined Areas for each notified crop for widespread calamities with the assumption that all the insured farmers, in a Unit of Insurance, to be defined as “Notified Area‟ for a crop, face similar risk exposures, incur to a large extent, identical cost of production per hectare, earn comparable farm income per hectare, and experience similar extent of crop loss due to the operation of an insured peril, in the notified area.

- Defined Area (i.e., unit area of insurance) is Village/Village Panchayat level by whatsoever name these areas may be called for major crops and for other crops it may be a unit of size above the level of Village/Village Panchayat. In due course of time, the Unit of Insurance can be a Geo-Fenced/Geo-mapped region having homogenous Risk Profile for the notified crop.

- For Risks of Localised calamities and Post-Harvest losses on account of defined peril, the Unit of Insurance for loss assessment shall be the affected insured field of the individual farmer.

Concerns:

- An analysis of the government’s flagship national agriculture insurance scheme, the Pradhan Mantri Fasal Bima Yojana (PMFBY), has suggested that while being far superior to previous such schemes, its implementation is seriously compromised.The report was released by New Delhi based non-profit Centre for Science and Environment.

- Gaps in assessment of crop loss: The sample size in each village was not large enough to capture the scale and diversity of crop losses. In many cases, district or block level agricultural department officials do not conduct such sampling on ground and complete the formalities only on paper. CSE also noted lack of trained outsourced agencies, scope of corruption during implementation and the non-utilisation of technologies like smart phones and drones to improve reliability of such sampling.

- Inadequate and delayed claim payment: Insurance companies, in many cases, did not investigate losses due to a localised calamity and, therefore, did not pay claims.

- Massive profits for insurance companies: CSE’s analysis indicates that during kharif 2016, companies made close to Rs 10,000 crore as ‘gross profits’.

- Coverage only for loanee farmers: PMFBY remains a scheme for loanee farmers – farmers who take loans from banks are mandatorily required to take insurance.

- Poor capacity to deliver: There has been no concerted effort by the state government and insurance companies to build awareness of farmers on PMFBY. Insurance companies have failed to set-up infrastructure for proper implementation of PMFBY. There is still no direct linkage between insurance companies and farmers. Insured farmers receive no insurance policy document or receipt.

- The report has also identified issues like delayed notification by state governments, less number of notified crops than can avail insurance, problem with threshold yield estimation etc. that has diluted the usefulness of PMFBY.

- One of the key conclusions of the report is that PMBY is not beneficial for farmers in vulnerable regions. “For farmers in vulnerable regions such as Bundelkhand and Marathwada, factors like low indemnity levels, low threshold yields, low sum insured and default on loans make PMFBY a poor scheme to safeguard against extreme weather events.

How to improve implementation

- Coverage of tenant and sharecropper farmers should increase.

- All important crops should be covered under crop insurance. Diversification of crops and mixed farming should be promoted.

- Instead of threshold yield, ‘Potential yield’ should be used for crops for which historical average yield data is not available.

- Farmers must be informed before deducting crop insurance premium. They must be given a proper insurance policy document, with all relevant details.

- Panchayati Raj Institutions and farmers need to be involved at different stages of implementation.

- The insurance unit (IU) must be reduced over a period of time. In any case, it should not be more than village level. If the IU cannot be at the individual level and is kept at village panchayat level, premium should also be collected at the village panchayat level.

- Incentivise groups of small farmers or women farmers and promote group insurance.

- Sum insured should not be less than scale of finance and/or cost of production.

- PMFBY timelines from insurance coverage to claim payment should be strictly adhered to.

- Robust assessment of crop loss should be done through capacity building of state governments, involvement of PRIs and farmers in loss assessment, auditing and multi-level checking to ensure credibility of data and testing incorporating technology such as remote sensing, drones and online transmission of data.

- All PMFBY related data related to farmers must be available in the public domain and shared openly with farmers.

- The clause addressing prevented sowing and post-harvest losses must be implemented appropriately by issuing state notifications prior to sowing.

- Robust scheme monitoring and grievance redressal mechanism should be in place.

Conclusion:

- In an era of climate change, a universal, subsidised agriculture insurance is crucial to safeguard the lives and livelihoods of farmers. But we need a farmer-friendly, fair and transparent agriculture insurance.

Source:Down to Earth and Vikaspedia