International Relations: IMF:Article – Analysis

Mains Topic:GS-2

International Relations

Members of Bretton Woods Family or Bretton Woods Twins

- International Monetary Fund(IMF): To maintain global financial stability through technical assistance, training, and loans to member states to tide over short term balance of payment crisis.

- World Bank (WB) Group:Consisting of 5 agencies which provides vital financial and technical assistance to developing countries around the world to reduce global poverty

IMF

Introduction

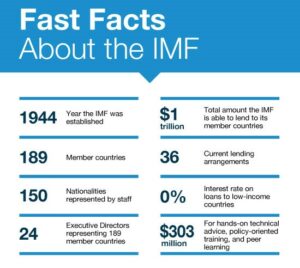

- The International Monetary Fund (IMF) is an international organization headquartered in Washington, D.C., consisting of “189 countries working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world.

- “Formed in 1944 at the Bretton Woods Conference primarily by the ideas of Harry Dexter White and John Maynard Keynes, it came into formal existence in 1945 with 29 member countries and the goal of reconstructing the international payment system.

- It now plays a central role in the management of balance of payments difficulties and international financial crises.Countries contribute funds to a pool through a quota system from which countries experiencing balance of payments problems can borrow money.

Objective

- Ensure the stability of the international monetary system. It does so in three ways:

- keeping track of the global economy and the economies of member countries

- lending to countries with balance of payments difficulties

- giving practical help to members

- IMF’s role was fundamentally altered after the floating exchange rates post 1971

- Shifted to examining the economic policies of countries

- Researched what types of government policy would ensure economic recovery

- Its function became of surveillance of the overall macroeconomic performance of its member countries

- Now manages economic policy instead of just exchange rates + Promotes international trade

- Publishes surveys on world economy → World Economic Outlook

IMF Quota & Voting Rights:

- Quotas was assigned to member countries reflecting their relative economic power & credit deposit to IMF

- Subscription was to be paid 25% in gold or currency convertible into gold (effectively the dollar, which was the only currency then, still directly gold convertible for central banks) and 75% in the member’s own currency

- Members were provided voting rights in proportion to their quota, hence member countries with higher quota have a higher say at IMF.

Special Drawing Rights

- Special drawing rights (SDRs) are supplementary foreign exchange reserve assets defined and maintained by the International Monetary Fund (IMF)

- SDR is not a currency, instead represents a claim to currency held by IMF member countries for which they may be exchanged.

- The value of an SDR is defined by a weighted currency basket of four major currencies: the US dollar, the euro, the British pound, the Chinese Yuan and the Japanese yen

- Central bank of member countries held SDR with IMF which can be used by them to access funds from IMF in case of financial crises in their domestic market.

IMF reform in quota

- IMF Executive board decides the Quota of each member based on various parameters including GDP & tariff barriers.

- Higher quota gives higher voting rights and borrowing permissions, But formula is designed in such way US has ~18% quota, G7 collectively own >40% while India and Russia have barely ~2.5% each.

- BRICS, G20 and emerging market economies are against this scheme especially after Subprime crisis and declined economic strength of USA & G7

- 2010: Board decided to increases quota of developing countries albeit mainly by decreasing the quota of poor countries.

- Problem : 70% votes required to implement this reform, not 70 nations, & the nations who collectively own 70% quota- USA, Germany, Japan etc. Hence quota reform is pending.

Publications:

- World economic outlook

- Global financial stability report

- Fiscal monitor

- Regional economic prospects

- Finance and Development

Some of the concerns and criticism about Bretton Woods twins:

- Critics of the World Bank and the IMF are concerned about the conditionalities imposed on borrower countries

- The World Bank and the IMF often attach loan conditionalities based on what is termed the‘Washington Consensus’, focusing on liberalisation of trade, investment and privatisation of nationalised industries <so if India asked for funds from IMF, it might ask India to allow FDI in multi brand retail, to end system of minimum support prices in agriculture, privatize coal India etc.>

- Many infrastructure projects financed by the WB Group have social and environmental implications for the populations in the affected areas

- For example, World Bank-funded construction of hydroelectric dams in various countries has resulted in the displacement of indigenous peoples of the area

- Criticisms against the governance structures which are dominated by industrialized countries <unwritten rule that president of World Bank will be from USA and Managing Director of IMF from Europe

- Decisions are made and policies implemented by leading industrialized countries, the G7, because they represent the largest donors without much consultation with poor and developing countries < Countries which would utilize that assistance not even consulted,>

India and the IMF equation

- India and IMF have had an amicable relationship, which has beneficial for both. IMF has provided India with loans over the years and this has helped the country in times of Balance Of Payments (BOP) crisis pressure

- India joined the IMF in 1945, as one of the original founding members

- IMF credit has been instrumental in helping India respond to emerging BOP problems on 2 occasion

- In 1981-82, India borrowed SDR 3.9 billion

- In 1991-93, India borrowed a total 2.2 billion under 2 stand by arrangements, and in 1991 it borrowed SDR 1.4 billion under Compensatory Financing Facility

As a member of the Fund, India has derived following benefits

Foreign Exchange for Meeting BOP Deficits:

- Such drawings of foreign exchange have enabled the country to tide over the acute foreign exchange crisis and to maintain the imports of essentials goods

Oil Facility from the IMF:

- India resorted to drawing from the IMF under the Oil Facility created in June, 1974 to meet larger outlays for the import of petroleum crude.

Assistance under SDRs:

- The SDRs provide unconditional liquidity since the participants have access to foreign exchange resources at will.

- The country has made use of the Fund’s facilities a number of time Aid from the World Bank: The country’s membership of the IMF has entitled it to become a member of the World Bank; as a member of the Bank, India has received large technical and financial assistance for the various development projects

- Assistance under the Extended Credit Facility: Loan under this facility is contracted at softer terms but there is a serious conditionality clause attached to it

- Preparation of Valuable Reports: The country has availed the services of the specialists in the Fund for the purpose of assessing the state of the Indian economy and for preparing valuable reports on various aspects of the economy.

Source:IMF, Hindu and Wikipedia